new capital gains tax plan

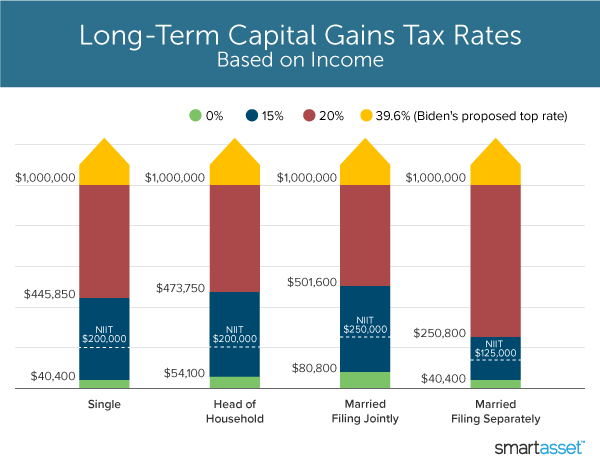

Raising Long-Term Capital Gains Tax Rates for High-Income Earners Biden proposes raising the long-term capital gains tax bracket from 20 to 396 for anyone earning more than 1 million per year. Tax filing status 0 rate 15 rate 20 rate.

Can Capital Gains Push Me Into A Higher Tax Bracket

States That Dont Tax Capital Gains.

. While the estate tax exemption at a little over 11 million per person exemption for capital gains tax would remain there would be the capital gains. A heated debate is happening between stock market players and members of the political community over the financial authoritys recent decision to sharply lower standards for large shareholders subject to capital gains tax. Smart taxpayers will start.

All Major Categories Covered. That would be the same top tax rate as regular income. After federal capital gains taxes are reported through IRS Form 1040 state taxes may also be applicable.

Under this proposal the 396 capital gains rate would apply to long-term and short-term gains as well as dividends. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. Tax capital gains and dividends at 396 on income above 1 million and repeal step-up in basis-002.

Individuals with AGI under the 1M threshold will continue to follow our current capital gains tax regime. Americans are facing a long list of tax changes for the 2022 tax year. Read customer reviews find best sellers.

15 corporate minimum book tax-021. Currently all long-term capital gains are taxed at 20. Restore estate and gift taxes to 2009 levels-015.

Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments. Read this guide to learn ways to avoid running out of money in retirement. Select Popular Legal Forms Packages of Any Category.

The new tax law also retains the 38 NIIT. This is essentially equivalent to those earners. The plan calls for a minimum 20 tax rate on income and unrealized capital gains of those worth over 100 million.

The highest long-term capital gains rate would rise to 25 while the 38 Medicare surcharge for high-income investors would push that rate to 288. Ad Browse discover thousands of brands. H ouse Democrats are plotting to raise the capital gains rate as one of several mechanisms to raise trillions of dollars for their new spending package.

The president would raise the top capital-gains rate to 396 from the current 20 for assets sold after more than a year of ownership. What You Need to Know. Raise the corporate income tax to 28-097.

President Joe Biden unveiled a 58 trillion budget. When you include the 38 net investment income tax NIIT that rate jumps to. The Democrats are also proposing to add a 3.

Under the new rule those who own 300 million won 260000 worth of shares down sharply from the current 1 billion won will have to pay. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. Short-term capital gains.

4 rows 2021 Long-Term Capital Gains Tax Rates. Achieve Your Goals By Using The Right Services Subject Expertise For Your Business. Limit the tax benefit of itemized deductions at 28 of value for those earning over 400000-009.

The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers. Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0 15 and 20. 46th president of the United States since 2021.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Ask Independently Verified Business Tax CPAs Online. Assets other than stocks may have different rates for capital gains taxes.

This new capital gains tax bracket would apply only to individuals with adjusted gross income AGI in excess of 1 million. The president has also proposed increasing the capital gains rate to 396 from 20 for households earning 1 million or more bringing that rate in line with the top marginal income tax rate. Hawaiis capital gains tax rate is 725.

That applies to both long- and short-term capital. Ad 247 Access to Reliable Income Tax Info. The current proposal is that the capital gains rate for high-income individuals be increased from 20 to 25 a number that falls short of President Joe Bidens initial pitch to.

Short-term gains are taxed as ordinary income based on your personal income tax bracket. Talk to Certified Business Tax Experts Online. So for 2018 through 2025 the tax rates for higher-income people who recognize long-term capital gains and dividends will actually be 188 15 38 for the NIIT or 238 20 38 for the NIIT.

Tax Changes and Key Amounts for the 2022 Tax Year. Get Tax Lein Info You Can Trust. You can contribute 61000 up 3000 from the year prior.

A self-employed pension plan or SEP plan works like a 401k and IRA hybrid. Dont Forget The Net Investment Income Tax The 396 rate would be in addition to the current 38 net investment income tax NIIT for a combined total of 434.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Capital Gains Tax

The Tax Impact Of The Long Term Capital Gains Bump Zone Capital Gain Capital Gains Tax Tax

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax What Is It When Do You Pay It

Joe Biden Tax Plans Proposals Tax Foundation

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

How Capital Gains Affect Your Taxes H R Block

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Tax Advice News Features Tips Kiplinger

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Double Taxation Definition Taxedu Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)